How to Build Your Beauty Brand on Top China Social Apps the Right Way

Why China Is the Next Beauty Frontier

China’s beauty market is booming. As Gen Z and Millennial consumers turn to China social apps like Xiaohongshu, Douyin, and WeChat for skincare guidance and trend discovery, beauty brands have a unique opportunity—but also a challenge. The rules of engagement are different here. Content must be local, authentic, and algorithm-friendly.

At Twish China Marketing, we’ve helped global skincare and beauty brands steadily grow their followers on Xiaohongshu and achieve 10%+ e-commerce conversion rates—without massive ad budgets. Here’s how to enter the Chinese beauty space the right way.

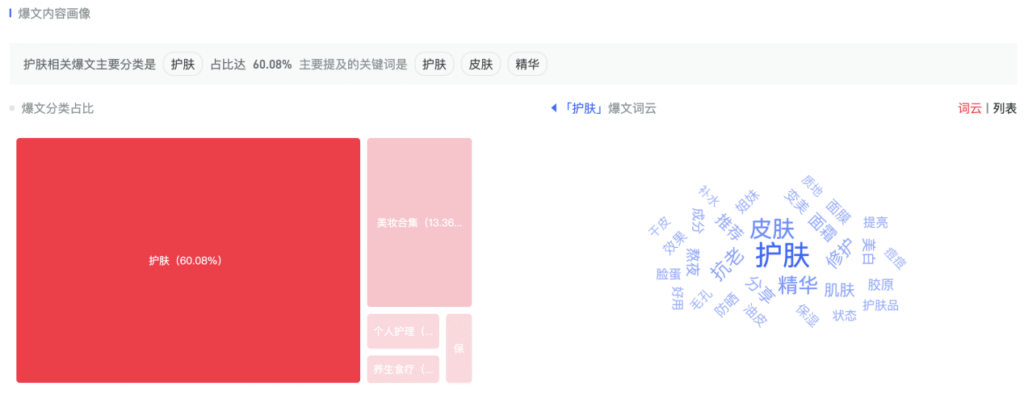

Based on data from the New Rank platform, we have analyzed the trends and characteristics of beauty and skincare content notes on Xiaohongshu. This insight will help you create a brand image and storytelling tailored to the Chinese market, attracting more Chinese consumers to discover and engage with your brand.

Understand What Chinese Beauty Consumers Really Want

Skin Goals, Search Habits & Hot Topics

Unlike in the West where consumers browse for brand prestige or clean formulas, Chinese users are driven by skin results, social validation, and peer-driven content. They search Xiaohongshu using terms like:

- “抠搜护肤” (budget skincare)

- “抗老” (anti-aging)

- “敏感肌卸妆” (sensitive skin cleansing)

Beauty trends emerge from lived experience and user-generated content. “You won’t believe this $5 cream fixed my barrier” resonates more than “award-winning peptide serum.”

Strategy Tip:

Before entering the market, invest in consumer insight + competitive landscape research. A proper market entry strategy blends China business growth goals with local search trends.

Why Xiaohongshu Is the Top App for Beauty Brands

The Beauty App That Influences Every Stage of Purchase

✨Why Xiaohongshu?

- Over 300M users

- 70% are female, aged 18–35

- High product discovery-to-purchase ratio

Xiaohongshu (Rednote) functions like a hybrid of Pinterest, Instagram, and Amazon. Consumers don’t just browse—they buy. It’s the top funnel, middle trust builder, and bottom-funnel converter in one.

✨Content Trends from 2025 Q1:

According to Twish’s Q1 skincare trend report:

- Experience-sharing titles drive the most interaction

- Ingredient-trusted and analysis-based content

- How-to tutorials continue to appeal to students and gym-goers. This format’s clarity, step-by-step structure, and actionable guidance make it a consistent performer.

- KOL skincare diaries attract young, aspirational followers

Strategy Tip:

Use Xiaohongshu for brand storytelling and emotional resonance, not direct selling. Chinese branding strategy requires subtle influence > hard push.

Localize or Lose: Brand Storytelling That Converts

Don’t Translate—Transform

It’s not enough to convert your Western assets into Mandarin. You must reinterpret your brand values to resonate with Chinese beauty ideals.

Example:

- Instead of “clean beauty,” emphasize ingredient-oriented for skincare content

- Instead of “hydration,” talk about achieving “Korean glowing skin nature”

- “Oil cleansing method: Deep dive analysis”

These posts attract users looking for clear, result-focused content that’s easy to understand and apply in their own routines.

How to Craft Messaging That Connects

We suggest to develop positioning tiers based on your audience. Are you:

- Budget-friendly yet effective?

- Premium anti-aging with derm credibility?

- Vegan & sensitive skin-safe?

Strategy Tip:

Run brand diagnosis workshops before launching. Adjust voice, visuals, and value propositions to the local psychographic segments.

Build a Xiaohongshu Content Engine

Content Types That Dominate Xiaohongshu

- Personal storytelling posts with Before/after transformations

- Ingredient-trusted and analysis-based content

- Product routine breakdowns

- KOL routines & UGC amplification

SEO Titles That Boost Discoverability

We recommend:

- At Least 12–16 posts/month with strategic SEO title, embedded content and tags. (title is the most important, and the keywords layout in the post)

- Topic clusters around skin goals, e.g., anti-aging, skin repair, beautytips, skincare

- Incorporation of search-triggering titles.

Strategy Tip:

Use content not just for engagement but as micro-tests for product-market fit. Track what “saves” and “comments” perform best—it reveals intent to buy.

Boost Results with Influencers and Paid Ads

Why Micro-KOLs Drive Better ROI

Chinese consumers trust people like them. Micro-influencers (5K–50K followers) often outperform celebrities in both engagement and conversions.

However, in most scenarios, fans closely follow celebrity routines, and content that mimics or reveals day-to-day skincare habits sees high stickiness and community interaction. Daily skincare diaries also rank high in engagement, especially among celebrity fans and young users but might drive lower conversion if the product that value-for- the-price enough.

To have a briefing strategy for KOL and KOC collaboration, you can look into our China Social Media Quichstarter Guide: Xiaohongshu & WeChat Practices. Further tailored influencers’ marketing strategy will be covered in our package.

Smart Paid Media: What to Promote and When

- Combine content seeding with search keyword ads

- Use Xiaohongshu AI tools by AI-powered targeting based on audience segment algorithm to boost top-performing contents

- Target by interest topics & hashtags (e.g., “anti-aging”, “sensitive-skin” “beautytips”)

Strategic Recommendations for Beauty Brand Content

Based on the above findings, content creators and brands should consider the following strategic priorities:

1. Prioritize Authentic Experience Sharing

Encourage users and KOLs to share personal skincare stories. Real experiences build trust and relatability, enhancing user engagement and content credibility.

2. Double Down on Educational Content

Consistently publish science-backed, explanatory skincare posts, especially targeting specific audiences like students and new mothers, to reinforce authority and build niche communities.

3. Leverage Trending Topics and Hashtags

Align content planning with hot keywords and hashtags to maximize visibility and increase the chance of recommendation by Xiaohongshu’s algorithm.

4. Blend Influencers with Relatable Routines

Have influencers skincare routines first as inspiration(not directly go into celebrity marketing) while localizing the content with personal narratives. This hybrid model can attract younger users while maintaining authenticity.

Use WeChat to Build Loyalty After Conversion

CRM, Retargeting, and Mini-Programs

Once a follower converts to a customer, the journey doesn’t stop.

Use WeChat to:

- Retain users via mini-programs & loyalty rewards

- Push CRM-based campaigns with coupons and exclusives

- Offer 1:1 clientelling via WeCom

- Gather fans in groups to ceaselessly doing brand education

This is your retention engine, closing the loop between social discovery and repeat purchase.

Track What Matters: Beyond Follower Counts

The KPIs That Reveal Growth, Not Just Follower Count

Growth means nothing without ROI. We also look into

- Saves and Shares (purchase intent signals)

- Keyword search rank

- DMs and Leads generated

- E-commerce conversion rates

- Clicks and stay duration

- User journeys

We deliver monthly insight reports that merge analytics with actionable optimization and insights from market and competitors.

Right Strategy Over Spend

China’s beauty space is not a volume game—it’s a precision game. Western brands that win:

- Localize deeply

- Embrace soft-sell storytelling

- Use platforms like Xiaohongshu strategically

- Treat content as a branding asset, not just a post

Whether you’re a startup or a seasoned brand, Twish helps you build with purpose—from insight to impact.

Ready to grow your beauty brand in China the right way?

➡️ Schedule your free 15-minute strategy call