How Global Furnishing Brands Can Win on China’s Social Platforms

The Chinese home furnishing and furniture market isn’t just growing—it’s evolving. Once dominated by functionality and price considerations, this market has shifted towards expressing personal aesthetics and identity. For today’s Chinese consumers, storytelling around brands has become equally, if not more important, than the products themselves—this is especially true for furnishing China marketing services.

With over 300 million monthly users, Xiaohongshu (RED) has become a digital haven for young, affluent Chinese city dwellers looking not just to browse, but genuinely live out their personal tastes. However, while the volume of content has significantly risen, engagement has noticeably declined. This means merely being present isn’t enough anymore—brands must stay deeply relevant to their target audiences.

Interestingly, despite saturation, price isn’t always the first concern for Xiaohongshu’s quality-conscious users. For instance, premium brands like Poliform and Baxter continually receive impressive inquiries and leads, demonstrating that well-targeted positioning can attract high-end consumers. Real-world examples of this phenomenon are explored in detail further down in this article.

For international furnishing and furniture brands—whether you’re an accessible Scandinavian label or a high-end Italian house—China’s digital landscape offers substantial opportunities if you localize strategically. This article delves into the key trends, effective platforms, and actionable strategies to successfully navigate one of the world’s most competitive consumer markets.

Understanding China’s Digital Furnishing and Furniture Landscape

Chinese consumers today are investing in more than just furniture; they’re buying an identity, emotional comfort, and a design ethos. Understanding this sentiment is critical for furnishing digital marketing in China.

A. Platform Deep Dive

Xiaohongshu (RED) has established itself as a platform that thrives on aesthetics, storytelling, and social validation, making it perfect for brand awareness and inspiration-based buying.

Meanwhile, WeChat transcends being just a messaging app—it’s an integrated ecosystem offering CRM, e-commerce, content management, and customer loyalty capabilities.

Douyin (the Chinese counterpart of TikTok), on the other hand, excels at generating viral exposure. Its algorithm distributes content widely, providing excellent visibility opportunities for large brands. However, due to its vast user base and algorithm-driven public content distribution, Douyin tends to appeal more to price-sensitive consumers with lower purchasing power, making it less suitable for premium or luxury international brands compared to Xiaohongshu and WeChat.

B. Current Content Landscape

From 2024 to 2025, content volume on Xiaohongshu rose sharply from approximately 15K to over 20K posts daily. However, engagement declined below 600K daily interactions, signaling market saturation. Users now prefer emotionally engaging content, shifting away from straightforward product showcases to more narrative-driven, relatable stories. For example, instead of showcasing a sofa merely by its design, posts now highlight personal stories like “How this chair improved my mornings.”

We can see clear evidence of this transition from Xiaohongshu’s furnishing and furniture content trends data between 2024 and 2025.

Key Shifts & Observations

| Category | 2024 | 2025 | Implication |

| Content style | Practical & tutorial-based | Emotional, lifestyle, metaphor-driven | Shift from “how” to “why it matters” |

| User attention | Spiky, responsive to viral themes | Flatter, harder to go viral | Content fatigue and higher bar for standout ideas |

| Algorithm bias | Structured content gets traffic | Emotion-rich stories get better push | Platform favors “hook + engagement depth” now |

| Interaction type | Comments & saves together | Fewer comments, mostly passive views | Push interaction triggers early and clearly |

What Drives Success on Xiaohongshu Today

Chinese Gen-Z and millennial homeowners prioritize meaning over mere functionality. Brands that align their narratives with consumers’ lifestyles and emotional needs succeed. This emotional resonance has become essential for any furnishing Xiaohongshu agency.

Winning Content Formulas in 2025

[Hook title] + [Life challenge] + [Decision logic] + [Result] + [Emotional line]

Effective content combines practical insights with relatable storytelling, typically structured as follows: a compelling hook, relatable challenge, clear decision-making rationale, tangible results, and a concluding emotional insight. A typical example might be, “This isn’t just a lamp—it helped me survive burnout after work.”

Top trending themes in 2025 include sofas tailored to personality types (e.g., INFJ-style sofas), DIY projects transforming failures into successes, clever spatial organization hacks, and humor-driven narratives. Especially for China’s growing middle class, micro-space optimization remains a critical concern, drawing them towards Ikea-style and Japanese or Korean-style furnishings.

Brands should adjust content directions from basic feature introductions toward real-life scenarios and emotional storytelling. Rather than technical guides, content should humanize experiences, incorporating humor and comparative insights.

User Preferences Evolving

In contrast to 2024’s focus on instructional content, 2025 sees emotional aesthetics, humor, and relatable storytelling dominating. For instance, instead of generic sofa selection advice, posts narrate humorous yet heartwarming stories like “I bought this couch because my mother disliked it—and now she’s always using it.”

Chinese Gen-Z and millennial homeowners care about meaning, not just design. They buy brands that speak their language—and increasingly, that means a shift from functionality to feeling. This is a key focus for furnishing Xiaohongshu agency services.

Strategic Suggestions for 2025 Furniture Content

| From | To |

| Feature introductions | Real-life moments, family scenes, regrets or surprises |

| Decor theory | Decision stories: “Why I chose this & what happened” |

| Technical guides (measurements, styles) | Humanized stories, comparisons, and punchline captions |

Recommended Themes & Storylines for 2025

| Type | Story Ideas |

| Emotional daily life | “My dad’s favorite thing is to just sit on this chair and stare out the window.” |

| Functional failures | “This desk? My mom’s complained about it 3 times already.” |

| Soft seeding | “This lamp isn’t for light—it’s my reset button after work.” |

| Scenario bundles | “Entryway + wardrobe + track door: the full flow of movement in one shot” |

| Budget-friendly showcases | “2.8k full set—here’s what I still love months later” |

Case Study: 4 Brand Strategies in Action

Here’s how four international brands—two premium (Poliform, Baxter) and two accessible (IKEA, HAY)—successfully adapted their strategies for China, key insights typically seen in a furnishing Xiaohongshu marketing agency’s playbook.

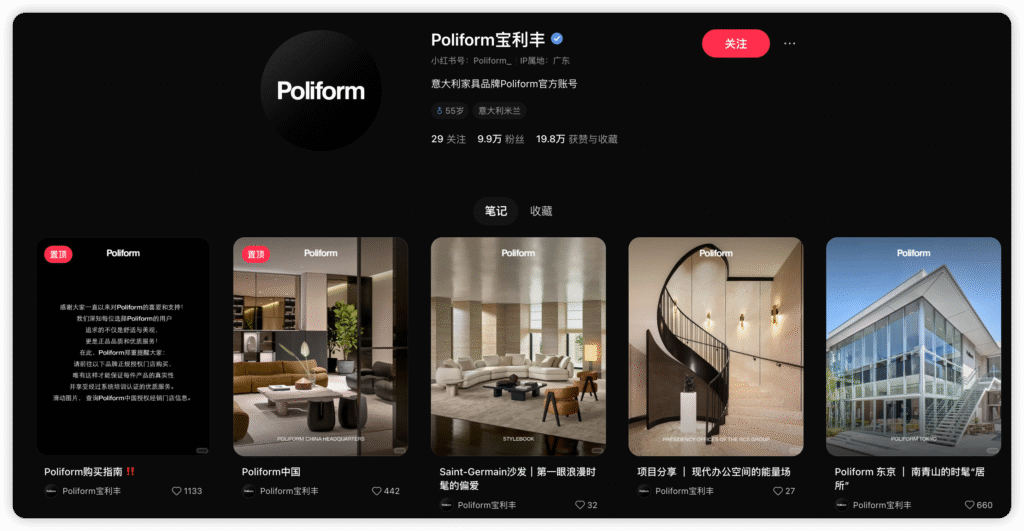

A. Poliform – Architectural Prestige, Local Relevance

Poliform, a renowned luxury Italian brand, effectively leveraged network strategies rather than mass marketing. They invested in high-end installations in prominent cities like Beijing and Shanghai, collaborated with well-known interior design influencers, and created immersive, cinematic content that mirrored the premium lifestyle Poliform symbolizes.

- High-end residential installations in Beijing and Shanghai

- Celebrity-endorsed showrooms

- Partnerships with interior KOLs on Xiaohongshu

Their RED NOTE content is cinematic, slow-paced, and serene—mirroring the experience of owning Poliform, not just sitting on it.

By 2025, Poliform established a new headquarters in Beijing, operating 27 independent showrooms across 24 Chinese cities. Strategic collaborations with local partners such as Ritz Furniture and JS Home expanded their reach further. Poliform also utilized comprehensive hashtags (like #PoliformFurniture, #PoliformSofas) and engaged influential home décor KOLs to amplify brand visibility among younger demographics. Regional Poliform accounts on Xiaohongshu managed by local distributors further strengthened consumer engagement. By mid-2025, Poliform’s Xiaohongshu account grew to nearly 100,000 followers, significantly increasing its influence.

B. Baxter – Artisan Heritage for Cultural Elites

Baxter’s strategy hinges on craftsmanship and sensory storytelling. Their primary channels include:

- WeChat for CRM and private showroom invites

- RED for artisan profiles and soft editorial-style stories

- Offline gallery events with experiential interiors

Their Chinese marketing avoids overt selling and instead builds reverence around legacy and materials. A recent RED post featured a behind-the-scenes leather dying process in Como, shared with poetic Mandarin captions.

C. IKEA – Everyday Affordability Meets Local Genius

IKEA capitalizes on user-generated content (UGC) and innovative furnishing hacks tailored to diverse life scenarios and customer personas. By promoting creative, affordable home improvement solutions, IKEA successfully integrates products into everyday user scenarios. Their success in China is partly due to:

- Encouraging RED users to post “IKEA hacks”

- Emphasizing storage-for-small-homes ideas

- Posts basen on different scenarios to fit into different products.

In China, IKEA strategically developed keywords around specific scenarios like “apartment renovations” and “small space storage,” converting daily living pain points into actionable, consumable narratives. IKEA’s Xiaohongshu campaigns, such as the “Clear Your GAP Day,” inspired users to share personal storage tips, amplifying brand exposure through UGC.

IKEA also prioritizes influencer partnerships, selecting KOLs known for high engagement rates. These collaborations focus on themes such as “warm family moments” and “home improvement inspiration,” fostering trust and increasing product familiarity. Additionally, IKEA actively embraced sustainability and ESG initiatives, such as launching furniture recycling and buyback services in 2024, encouraging environmentally responsible consumption.

D. HAY – Nordic Vibe with Modular Meaning

HAY positions itself between minimalism and modularity. On RED, its strategy focuses on:

- Soft lifestyle stories (e.g., design students’ first apartments)

- Small-space bundles like “dining nook for 2” sets

- Studio collabs with Chinese creators to reimagine local spaces

Unlike IKEA, HAY doesn’t shout value—it whispers style. That calm tonality resonates with urban professionals who want “quiet luxury” at accessible prices.

What Foreign Brands Often Get Wrong

Despite good intentions, many foreign brands still misstep in China. This is a key challenge in furnishing brand China market entry strategies.

Mistake #1: Translating global assets instead of localizing

Your Milan campaign may look beautiful, but it means nothing if your Mandarin copy feels stiff, and your room scenes ignore local architecture.

Mistake #2: Focusing on specs, not emotions

Selling on “solid wood” doesn’t compete with posts that say, “My dad just sits here in silence, staring at the window—and I finally get it.”

Mistake #3: Underestimating platform behavior

Posting catalog shots on Xiaohongshu? That’s digital wallpaper. You need narrative captions, aesthetic rhythm, and native user tone to even earn a second glance.

Building a Localized Content Strategy That Works

Your brand needs a home in China—but it must feel genuinely lived in. This fundamental principle is crucial for furnishing social media campaigns in China.

A. Positioning First

Deciding your brand’s positioning is crucial because being unclear or attempting to cater to every audience can easily backfire. It might be tempting for foreign brands to automatically position themselves at the high end to attract premium consumers. However, it’s important to recognize that blindly pursuing a luxury positioning without considering your existing brand identity, assets, and current market standing could result in mismatched expectations and disappointing outcomes. The key is to carefully find your authentic and appropriate positioning for the Chinese market, aligning closely with your brand’s core ethos. Interestingly, even with recent economic shifts, brands like IKEA continue to perform exceptionally well in China, demonstrating the effectiveness of clear positioning, whether premium or affordable.

Brands like Poliform and Baxter focus on emotional depth, editorial-style communication, and synergy between online narratives and offline experiences. Conversely, IKEA and HAY excel through practical utility combined with aspirational narratives, leveraging high levels of user-generated content (UGC) and creating relatable, micro-scenario content tailored to everyday life.

Choose the positioning

Poliform/Baxter? → Emotional depth, editorial cadence, offline synergy.

IKEA/HAY? → Utility-meets-aspiration, high UGC leverage, micro-scenes.

B. Content Ladders: TOFU → BOFU

- TOFU: Inspirational stories, lifestyle photo essays

- MOFU: “Why I chose this over X,” KOL home walk-throughs

- BOFU: Home transformation timelines, interactive giveaways

C. Content Formats That Perform

“Regret vs reward” comparisons: budget vs premium items

Metaphor-led stories: “This bookshelf taught me patience.”

In conclusion, understanding and genuinely engaging with the emotional and practical lives of Chinese consumers, adapting content strategies accordingly, and leveraging influential platforms like Xiaohongshu are key to successfully penetrating and thriving in China’s dynamic furniture market.

Partnering with the Right Local Team

Execution in China is complex. Language, timing, and cultural rhythms must align. A native agency partner bridges global vision with local execution. This is especially vital for brands seeking China business growth.

At Twish, we combine:

- Brand audits and market entry workshops

- In-house native content creators

- Platform-specific performance optimization

- paid-media strategies, execution and optimization

- Agile sprints for campaign validation

Our team helped one Japanese-styled home brand grow revenue by 400K RMB on RED within 90 days. We don’t just translate content—we build stories that click. That’s the foundation of a solid Chinese branding strategy.

Your Story, Made Local

China’s furnishing and furniture market is fast, nuanced, and emotionally rich. Success isn’t about louder ads or lower prices—it’s about making your brand feel like home.

To win in 2025 and beyond, remember:

- Choose your platforms carefully.

- Tell stories that feel true to local users.

- Invest in localization, not duplication.

If you’re ready to adapt with purpose, China is still the biggest furniture story you’ve yet to tell.