The Ultimate Guide to China Influencer Marketing for Brands 2025

Author: Jonathan-Wang

Understanding China Influencer Marketing

If you’ve landed here searching for a China influencer marketing guide, let me level with you: China is a whole different beast when it comes to digital marketing. Forget everything you know about Instagram collabs or TikTok giveaways in the West. The Chinese market is a parallel universe, with its own platforms, influencers, slang, and rules of engagement.

Here’s the deal. Influencer marketing in China isn’t optional—it’s essential. If you want to build awareness, trust, and conversions fast, you’re not going to get there with just SEO or paid ads. You need real people, trusted voices, who can cut through the noise and give your brand instant credibility. And in China, those voices are called KOLs and KOCs or even KOSs.

What is it and why is influencer marketing essential for the Chinese market?

Influencer marketing in China boils down to this: people trust people more than brands. That’s not unique to China, but the intensity of this trust is. In a market where traditional advertising is often seen as background noise, consumers turn to influencers for buying decisions.

Imagine this: you’re launching a skincare brand in Shanghai. You could spend millions on metro billboards. Or, you could have one respected beauty KOL on Xiaohongshu (a mix between Pinterest and Instagram with steroids) show how your product fits into her nightly routine. Guess which one will actually get people to buy?

The Chinese consumer journey is community-driven. Shoppers aren’t just reading product specs. They’re scrolling Xiaohongshu notes, Douyin short videos, or Bilibili danmaku subtitling, looking for authenticity. That’s why influencer marketing is the backbone of modern China brand launches.

And here’s the kicker: if you’re an SME coming in from abroad, Chinese influencers are your shortcut to trust. No one knows your brand yet. No one cares about your fancy London HQ or your Silicon Valley tech team. They care about what their favourite influencer says about you.

KOL vs KOC: What’s the Difference and Which is Right for You?

You’ll hear two terms thrown around a lot in any China influencer marketing guide: KOLs and KOCs. Let’s break it down.

- KOL (Key Opinion Leader): Think macro-influencers. They have hundreds of thousands—even millions—of followers. These are celebrities, industry experts, or social media giants. They’re powerful, but they’re also pricey.

- Best for: Big awareness campaigns, fast reach, credibility building.

- Watch out for: High costs, less targeted audience, and sometimes inflated follower numbers.

- KOC (Key Opinion Consumer): Everyday users with smaller followings. We’re talking 500 to 5,000 followers. But here’s the secret: KOCs often drive higher trust and engagement because they feel like “real people.”

- Best for: Authentic word-of-mouth, niche targeting, budget-friendly campaigns. Twish provide UGC campaigns by leveraging KOCs.

- Watch out for: Smaller reach, so you’ll need volume (think dozens or even hundreds of KOCs).

Here’s a quick analogy:

- A KOL is like hiring David Beckham to endorse your sports drink. ➡️ Awareness

- A KOC is like getting 500 amateur footballers at your local club to recommend it to their mates. ➡️ Conversion

Clearly, the former one helps your brand on huge awareness, making audience feeling it is a big brand; and so, it is reasonable the KOL campaign usually be pricey. The latter rather be more sales-driven, especially for those products rely on trust! such as health supplement, fashion, skincare etc.

So, Which Should You Choose?

If you’re an SME dipping your toes into China, I’ll be brutally honest: start with KOCs. They’re cost-effective, they build grassroots trust, and they help you understand the market without blowing your budget on one campaign.

Once you’ve got traction? Scale with a KOL or two. That’s when you go from “unknown foreign brand” to “serious player.”

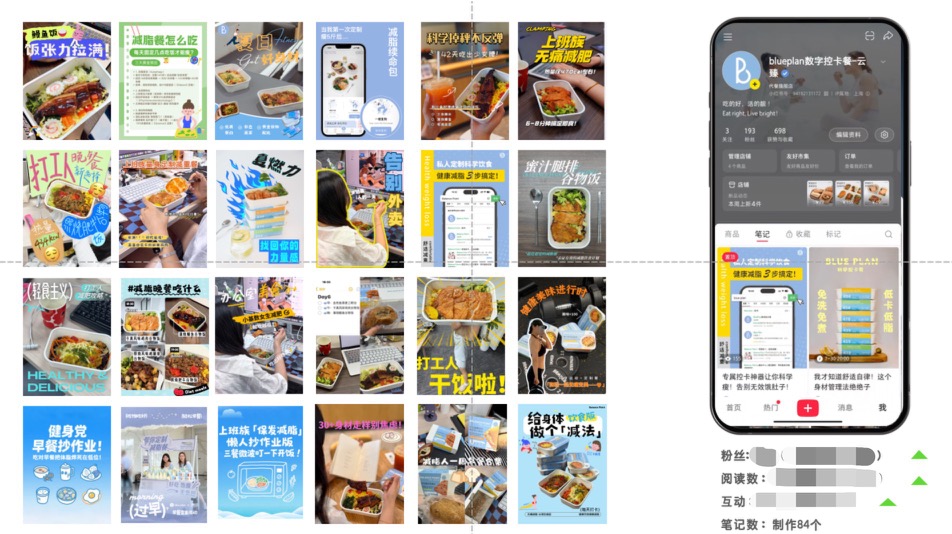

👉 Case Study on Health Brand – weight management food brand : Utilize micro KOL and bunch of KOCs

- Influencer marketing in China isn’t about vanity metrics. Don’t just chase follower counts. It is not so important if you want more from conversion.

- It’s about sales, conversions, and brand trust.

- And yes, it’s competitive, but if you play it smart—there’s still massive opportunity for SMEs.

By now, you know why China influencer marketing is non-negotiable and who the players are (KOLs vs KOCs). Next, we’ll dive into how to actually find and work with the right influencers in China.

How to Find the Right Influencers in China

If you’re still reading this China influencer marketing guide, chances are you’re already sold on the idea that influencers in China aren’t a “nice-to-have”—they’re the entry ticket. But here’s the question: how do you actually find the right ones?

This part is where a lot of SMEs trip up. They either:

- Pick influencers based purely on follower count (rookie mistake).

- Get burned by fake followers or dodgy agencies.

- Or worse, choose influencers who don’t align with their brand voice at all.

*Note: In 2025, some might use Head AI as their influencer marketing agent. But the truth is, you better have an agency who scout and vet for you and you make the final decision for the KOL/KOC list.

Types of Chinese influencers and how to vet them.

China has a crazy diverse influencer ecosystem. Here’s a quick breakdown so you don’t get lost:

- Mega KOLs (Celebrity Level)

- Millions of followers. Household names.

- Example: Viya (before her tax scandal) or Austin Li (aka the “Lipstick King”).

- Pro: They can make or break a product overnight.

- Con: Costs are sky-high, and campaigns are risky if they flop. and the selling price should be the lowest among Chinese market.

- Top KOLs

- 100k–500k followers.

- They often dominate niche categories (beauty, mum-life, tech, fitness).

- Pro: More affordable than mega KOLs while still offering strong reach and visibility.

- Con: Engagement rates can drop if they’re over-commercialised.

- Mid-tier KOLs / KOCs

- Anywhere from 50k to 100k followers.

- Bridge between niche creators and the mainstream.

- Pro: Good mix of credibility and affordability.

- Con: Not as viral as mega KOLs, not as authentic as KOCs.

- Micro KOLs / KOCs

- Anywhere from 1k to 50k followers.

- These are niche players, often hyper-focused on one category (beauty, fitness, parenting, tech).

- Pro: High engagement, authentic feel, great for “seeding” campaigns.

- Con: Need volume to scale impact.

- Livestreamers

- The kings and queens of conversion.

- Platforms like Douyin, Taobao Live, and Xiaohongshu/REDNote are full of livestream influencers who can sell out products in minutes.

- Pro: Perfect for product launches.

- Con: You need stock ready, and you need logistics nailed down.

👉 Pro tip: Most SMEs start with micro KOLs and KOCs for testing, then graduate to livestreamers once their supply chain can handle spikes.

How to Vet Chinese Influencers

Here’s where things get real. Anyone can look good on paper. What matters is whether they can move the needle for you.

Checklist to vet influencers:

- Engagement rate: Followers mean nothing if no one’s liking, commenting, or sharing. Look for consistent interaction.

- Audience fit: Are their followers your target demographic? (e.g., middle-class women in Tier 1 cities if you’re selling premium skincare).

- Content quality: Do they create content that feels authentic, or is it just product spam?

- Reputation: Search their name on Xiaohongshu or Weibo. Any scandals? Fake follower accusations?

- Past collaborations: Have they worked with foreign brands before? Did it look natural or forced?

👉 What Twish provide for your China influencer marketing

The role of an MCN agency.

You can’t talk about finding influencers in China without mentioning MCNs.

MCN (Multi-Channel Network) = influencer talent agency on steroids.

They manage groups of influencers, negotiate deals, and sometimes even control creative direction. Think of them as the middlemen between you and the influencers.

- Pros of working with an MCN:

- Easier access to top influencers.

- They handle contracts, payments, and sometimes campaign logistics.

- Can scale your campaigns quickly.

- Cons of working with an MCN:

- They’ll push their own roster, not necessarily the best fit.

- Costs can be inflated (commission stacked on top of influencer fees).

- Sometimes less creative flexibility—you’re on their terms.

My advice is:

- For SMEs starting out: Don’t rush into MCNs. Test smaller KOCs and independent KOLs first.

- Once you scale: An MCN can unlock bigger names and save you admin headaches.

Red Flags to Watch Out For

Because let’s face it—this space isn’t all sunshine. Here are the classic traps:

- Fake followers and bots. Influencer has 200k fans but gets 10 likes a post? 🚩

- Over-commercialisation. If they’re promoting five brands a week, your campaign will feel like noise.

- Contract vagueness. Always get deliverables, posting dates, and usage rights in writing.

- Unrealistic promises. “We guarantee 10,000 sales.” Run. No one can promise that.

Planning and Launching Your Campaign

By now, you know influencers in China are essential and you’ve got an idea of how to pick them. But here’s the truth: even the best influencer can’t save a bad campaign plan.

How to work with Chinese influencers step-by-step.

Step 1: Define Your Goals Clearly

Sounds obvious, right? But most brands skip this. Before you talk to a single influencer, ask yourself and be honest:

- Do you want awareness (people seeing your name)?

- Do you want engagement (comments, shares, followers)?

- Do you want sales (direct conversions)?

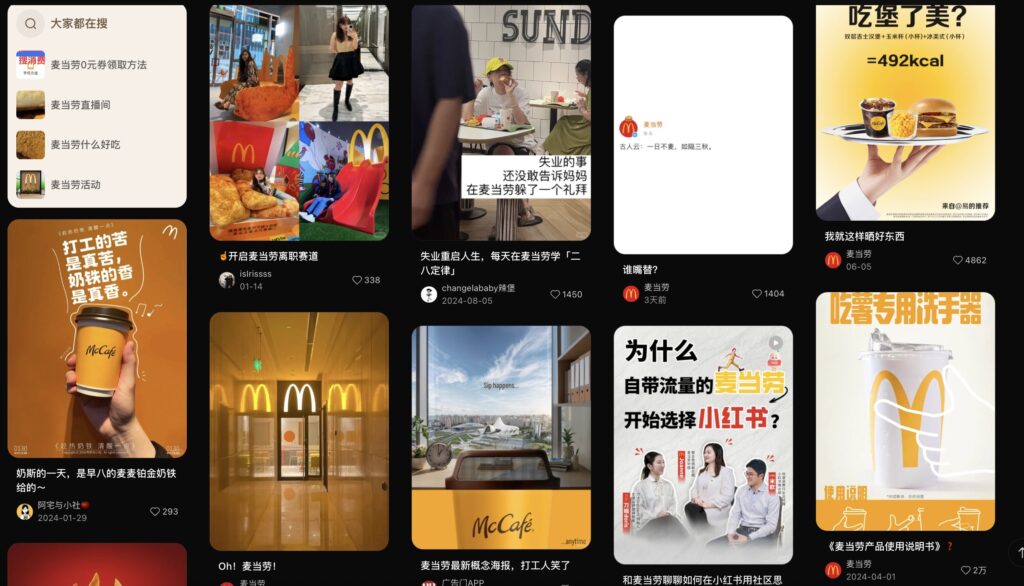

Example: A skincare brand might first run KOC seeding on Xiaohongshu just to get authentic reviews out there (awareness and credibility), and only later work with a Taobao live-streamer to drive sales once trust is built. REDNote cooperate with Tmall to track the performance of influencers which help you to bring real outcomes.

👉 Case Study on Lifestyle Brand – NewChi

Step 2: Choose the Right Platform

Not all platforms are created equal. A quick cheat sheet:

- Xiaohongshu (RED): Best for lifestyle, beauty, fashion, travel. Perfect for seeding, UGC, and discovery.

- Douyin (TikTok’s Chinese twin): Great for virality and short-form selling. Livestreams crush here.

- Weibo: More like Twitter meets celebrity news. Good for large-scale awareness campaigns. 👉We have run campaigns for concert, festivals and fashion shows with influencers marketing on Weibo.

- WeChat: Best for nurturing and community building, not discovery. We call it private-domain in China or say DTC.

- Bilibili: Geek culture, Gen Z, long-form product reviews. Think cameras, gaming, niche hobbies and where Youtubers doing tutorials.

Pick your battleground based on your audience and goals—not what’s trendy.

Step 3: Craft a Content Strategy with Influencers

This is where many foreign brands mess up. They send influencers Western-style briefs: “Please say X, please show Y, hashtag #brandlove.” And the result? A cringey ad that Chinese audiences scroll past. Instead, flip the script:

- Trust the influencer’s voice. They know what resonates with their fans.

- Set clear guidelines, not scripts. Define “non-negotiables” (brand name, key message, legal disclaimers), then give freedom.

- Push for storytelling. Audiences don’t want product specs. They want: “This cream fixed my winter dry skin in 2 weeks.”

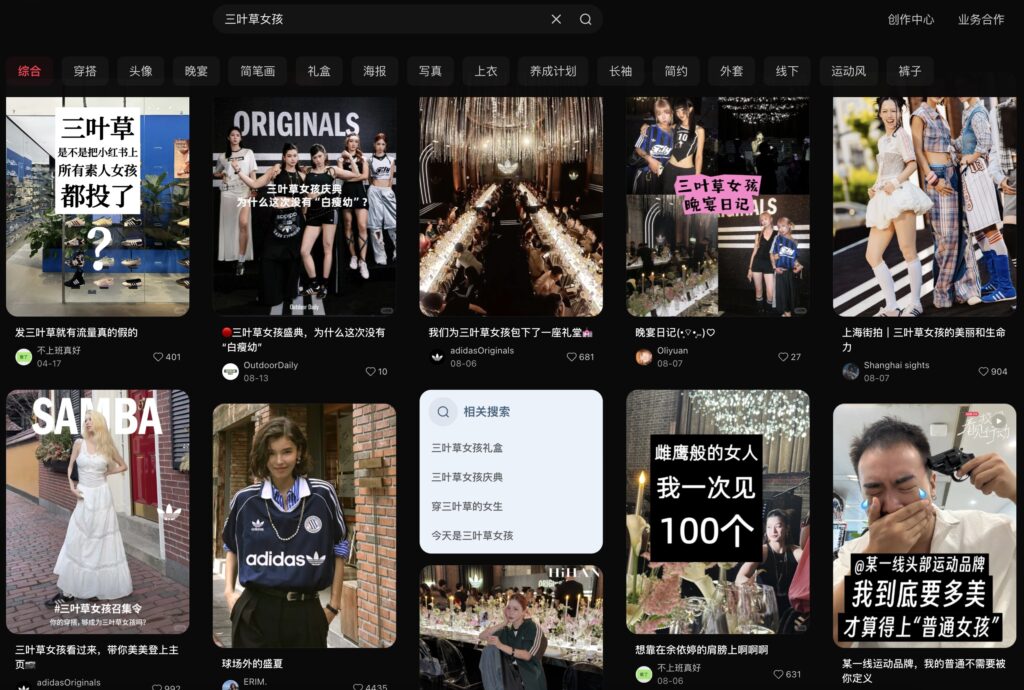

👉 Real-world example placement: “A sports brand gave Xiaohongshu influencers a free pass to create their own daily OOTD and invite them to a high class gathering. KOCs can post freely about the gathering on Xiaohongshu/RedNote. Result? Millions of views and organic participation.”

Step 4: Legal and Compliance (Don’t Skip This)

China isn’t the Wild West. There are strict rules around advertising and influencer marketing. Ignore them and you’ll risk fines or getting banned from platforms. Key things SMEs must know:

- Advertising Law: Bans false claims (e.g., “cures acne overnight”) or absolute terms (“best, number one”).

- Data & Privacy: Collecting user data through influencer campaigns? Make sure you comply with China’s Personal Information Protection Law (PIPL).

- Contracts: Always outline: deliverables, timelines, exclusivity, payment structure, dispute resolution.

- Product categories: Certain industries (health, baby products, financial services) are heavily regulated. Influencers promoting them must be extra cautious.

Step 5: Launch Smart

You don’t have to go all-in from day one. In fact, don’t. Start small.

- Pilot test: 10–20 KOCs on Xiaohongshu/ REDNote to seed content. (Each costs around USD 30)

- Phase 2: Expand to 20–50 micro KOLs for reach.

- Phase 3: Bring in a 24h live-streamer once you’re confident stock + logistics can handle demand and you want to boost sales (👉Look into the Best live-steaming agency in China)

This phased approach saves you from embarrassing stock-outs or wasted spend.

Step 6: Track in Real Time

Campaigns in China move fast. A Douyin post can go viral in hours, and if you’re not watching, you’ll miss your chance to amplify.

- Use platform-native analytics (Xiaohongshu backend, Douyin Starmap).

- Track beyond vanity metrics. Yes, likes are nice, but what about click-throughs, coupon redemptions, sales?

- Have someone on your team (or your agency) ready to respond in real time. Momentum is everything.

Content strategy and legal considerations.

Content Strategy: Winning Hearts, Not Just Views

- Localise Your Story

- Don’t just translate your English tagline. Reframe it in a way that resonates with Chinese culture.

- Example: A skincare brand in the West says “for sensitive skin.” In China, they might emphasise “for changing seasons,” because people link skin issues to weather shifts.

- Emotional Hooks Win

- Chinese consumers connect through storytelling.

- Example: A Douyin influencer doesn’t say, “This blender is powerful.” They film themselves making a quick breakfast for their kid before school—relatable, emotional, and persuasive.

- Formats That Work

- Xiaohongshu: Picture-heavy “note” style posts, with personal experiences.

- Douyin: Short-form video, ideally 15–60 seconds with catchy music.

- Bilibili: Deep-dive review videos, showing authentic product testing.

- WeChat: Long and professional articles, or interactive SVG content when announcing new launch.

- Frequency Matters

- One post won’t cut it. Plan for multi-post campaigns—reviews, tutorials, follow-ups. Trust is built over repetition.

👉 Golden rule: Let the influencer craft the story. You guide the message, not the execution.

Legal Considerations: Don’t Be the Foreign Brand That Gets Banned

You’d be surprised how many foreign brands crash and burn because they didn’t respect China’s advertising rules.

- No exaggerated claims. Words like “best,” “most effective,” “guaranteed” are illegal. Yes, illegal.

- Sensitive industries = extra scrutiny. Health, baby products, financial products, cosmetics—these need compliance checks.

- Influencer disclosure. Some platforms require clear labelling of sponsored content, such as Xiaohongshu/REDNote.

- Contract clarity. Cover:

- Posting schedule (specific dates & times)

- Deliverables (number of posts, formats, platforms)

- Usage rights (can you reuse the content on your channels?)

- Exclusivity (can they promote your competitor at the same time?)

China influencer marketing ROI and key metrics.

Key Metrics That Actually Matter

Forget vanity metrics. Here’s what I track when running influencer campaigns in China:

- Engagement rate (ER): Likes + comments ÷ followers. Benchmark:

- Micro KOLs: 10–20% ER.

- Mega KOLs: 2–5% ER.

- Click-through rate (CTR): How many people click the product link. (if linked to Tmall or mini-program)

- Conversion rate (CR): How many clicks turn into sales.

- Cost per acquisition (CPA): Total spend ÷ number of buyers.

- ROI: Revenue ÷ total campaign cost.

China KOL pricing and cost

How Much Do Chinese Influencers Cost? (Real Ranges)

This is where things get spicy. Costs fluctuate depending on platform, niche, and influencer tier, but here’s a ballpark you can actually plan with:

Xiaohongshu (REDNote)

- KOC (500–2k followers): Free products + $20–$50/post.

- Micro KOL (5k–40k): $100–$500/post.

- Mid-tier KOL (50k–100k): $700–$2,500/post.

- Top KOLs (100k+): $7,000–$12,000/post.

Douyin (TikTok China)

- Micro KOL (10k–50k followers): $100–$300/video.

- Mid-tier KOL (50k–500k): $300–$500/video.

- Top KOLs (500k+): $500–$1000/video.

- Livestreaming (commission model): Base fee + 40–70% of sales revenue. some might without base fee but usually weak performance.

- Mid-tier KOL (50k–200k): $10–$50/post. Weibo suits for few categories right now.

- Top-tier: $300–$500/post (yes, just for one tweet-like post).

Bilibili

- Long-form review (10–20 mins): depending on niche (tech reviewers command higher rates)

Tools for tracking campaign performance.

- Xiaohongshu Business Account Backend: Lets you see impressions, saves, shares.

- Douyin cloudmap: Tracks CTR, sales conversions from livestreams.

- WeChat native backstage: Great for tracking redemptions and direct conversions.

- Third-party tools (e.g., NewRank, KAWO): Aggregate influencer data, prevent fake follower scams.

That’s your playbook for measuring success: know the metrics, know the costs, know the risks.

Platform-Specific Strategies

“China isn’t one market. It’s five markets on five different platforms.”

If you’re still trying to apply your Instagram strategy to Xiaohongshu or your YouTube playbook to Bilibili, you’re going to fail. Not maybe. Not eventually. You will waste time and money. Because each Chinese platform has its own vibe, user behaviour, content preference, and influencer ecosystem.

This chapter is the secret sauce: how to tailor your China influencer marketing campaign by platform.

Xiaohongshu influencer marketing guide for “seeding” and UGC.

If you’re selling to urban women, Gen Z, or millennials, start here. Xiaohongshu (a.k.a. “RED”) is where trust is born.

People don’t come to RED to scroll — they come to search, discover, and evaluate. Think of it as a mix between Instagram, Pinterest, and TripAdvisor.

What Works

- “Seeding” Campaigns: Getting dozens (or hundreds) of micro KOCs to post their real experiences with your product.

- Photo-led “Notes” (图文笔记): Personal diaries, product reviews, unboxing, and side-by-side comparisons.

- Hashtag Strategy: Optimise with lifestyle keywords, not brand slogans.

- Authenticity Over Polish: Don’t over-produce. Raw = Real.

How to Win

- Start with KOCs: Seed with real users first.

- Incentivise UGC: Offer samples, small commissions, or invite-only campaigns.

- Track engagement: Save rates matter more than likes.

- Use influencer content as social proof: Reuse across WeChat or on DTC landing pages.

Real-World Example

A premium serum brand seeded 100+ KOC posts on REDNote before launch. Within few weeks, it had over 200 organic engagements from real users and local influencers — little spends.

Douyin influencer campaign for foreigners on short-form video.

If Xiaohongshu is about trust, Douyin is about attention. It’s loud, fast, addictive — and when you get it right, it’s a sales machine.

But foreigners often mess this up. They think Douyin is just “TikTok China.” It’s not. Algorithms are different. Culture is different. Users behave differently.

What Works

- 15–60 second videos with hard hooks in the first 3 seconds.

- Challenges, routines, or trends. Think lifestyle, humour, and transformation.

- Livestreaming: THE sales engine. Works best for beauty, snacks, gadgets, fashion.

- Affiliate Programs: Influencers can plug your product into their “product window.”

How to Win as a Foreign Brand

- Use Chinese faces: Sorry, but local creators perform better unless your product is inherently foreign.

- Focus on daily-life scenarios: Product + lifestyle + story = success.

- Repurpose with Douyin Spark Ads: Boost your best influencer videos with paid push.

- Plan logistics before you launch. Fast shipping, local customer service, and stock = mandatory.

Bilibili influencers marketing as a better on long-form video

If your brand is techy, thoughtful, or niche, Bilibili is your goldmine. This isn’t TikTok. It’s more like early YouTube meets Reddit — smart, Gen Z-heavy, and heavily community-driven.

Who’s Here

- Gamers

- Tech lover

- Anime fans

- Students

- Product reviewers

What Works

- 10–30 minute reviews, tutorials, and explainer videos

- Unfiltered, analytical content.

- Danmu (real-time comment overlays) = instant feedback and buzz

How to Win

- Find niche creators. Forget mass reach — go deep, not wide.

- Sponsor deep-dive content. Let them geek out on your product.

- Create learning-based campaigns. Especially for apps, tech, or higher-priced products.

- Community > Creator. Engage in the comments section. Respond. Reward.

Real-World Example

A smart home brand launched with multiple Bilibili influencers. Each did a detailed review with pros/cons and comparison video. No flashy ads, no gimmicks. Just raw, helpful content. The videos ranked top for over 3 months.

Podcast is the Emerging High-ROI Channel for influencer marketing

Most people ignore podcasts in China. Big mistake. While it’s still niche, podcasting is exploding among young professionals, creatives, and expats in Tier 1 cities. And it is truly affordable right now.

How to Use It

- Sponsor a segment or full episode

- Do a co-branded show (weekly or series-based)

- Provide talking points, but stay conversational

Bonus: Podcasts are often cheaper than video collabs but deliver much deeper engagement.

Real-World Example

Podcast “Little Universe” is suitable for health product and online training. A headache medicine cooperated with several Finance Podcasters to promote their product, precisely target their core audience with little cost and avoid the risk of publish content about medical on other platforms.

👉 Contact Us for more information about Podcasting influencer marketing in China

Navigating Weibo vs WeChat influencer marketing.

Let’s settle this: Weibo ≠ WeChat. They’re totally different beasts.

- Public-facing, open platform

- Great for trendjacking, virality, celebrity KOLs

- Best for top-funnel exposure and hashtags

- Private, closed ecosystem

- Ideal for content nurturing, loyalty programs, and conversions

- Best for B2B, education, luxury, or communities

How to Win on Weibo

- Partner with entertainment influencers

- Use hashtag campaigns to spark trends

- Pair with paid ads to maximise reach

How to Win on WeChat

- Use WeChat Official Accounts to repost influencer reviews

- Embed influencer content into WeChat Mini Programs

- Create closed brand communities (VIP buyers, referrals, etc.)

China influencer marketing isn’t one-size-fits-all — it’s a matrix. The real power? Comes when you use each platform for what it’s best at.

Beyond Influencers: Leveraging UGC

Let’s be honest: influencer campaigns are sexy, but user-generated content (UGC) is what builds empires.

Why? Because UGC is sustainable, scalable, and credible as hell.

In China, where trust is king and scepticism runs deep, people trust fellow consumers more than polished KOLs. UGC makes your brand feel real, relatable, and worth trying — especially if you’re new to the market.

China UGC marketing strategy: How to encourage authentic user-generated content to build trust.

Why UGC Matters More in China

- Low trust in ads. People think “if you paid them, they’ll say anything.”

- Collective decision-making. Shoppers look for consensus. They check reviews, social proof, comparison charts.

- Love of “sharing.” Especially Gen Z and urban millennials — they love being the first to discover something and tell their friends.

So when real users post about your product — unprompted or incentivised lightly — it hits harder than a big KOL campaign.

Strategy 1: Build a Seeding Machine

We touched on this in Chapter 5, but it’s worth repeating.

UGC starts with product seeding. Not just to influencers, but to regular users who:

- Match your target customer profile

- Are active on relevant platforms

- Like to post naturally

You don’t pay them. You give them a great product and a reason to talk about it. Then you amplify the best content — on WeChat, in Mini Programs, in your own REDNote or Douyin account.

Strategy 2: Feature Your Users Like Celebrities

In the West, it’s cool to go viral. In China? It’s status to be reposted by a brand. So if someone posts about your product?

- Repost it on your WeChat Official Account.

- Feature them in a customer spotlight on REDNote/ Little Red Book.

- Thank them with a personalised DM or coupon.

Simple tactics. Big results. Suddenly, your users start creating content just for the chance to be recognised. That’s the UGC flywheel.

Strategy 3: Create “Campaigns Without Asking”

Here’s a trick: instead of asking for UGC, create the conditions where it happens naturally.

- Launch a product with a built-in “first impressions” moment (like unboxing, taste test, before/after).

- Create hashtags that spark curiosity or identity (e.g., #MyFirstWeekWithX, #GlowySkinChallenge).

- Host a low-key offline event and let people document it themselves.

- Partner with micro-KOLs to show how they post — then regular users will mimic.

UGC can’t be forced. But it can be engineered.

Strategy 4: Build a Closed-Loop Trust Funnel

Here’s where strategy turns into ecosystem.

- Seed content from influencers + early adopters

- Users discover the content on RED, Douyin, or Weibo

- They buy → post about their own experience (UGC)

- Their UGC becomes new discovery fuel

- Cycle repeats

The brands that win in China aren’t loud. They’re embedded. In search results. In social scrolls. In user groups.

And in China, belief = sales. Most SMEs overspend on KOLs and ignore their best resource — the fans already talking about them.

The Latest Trends and Challenges

Things move fast here. Algorithms shift overnight. Livestream kings fall. One regulation and suddenly your campaign is illegal.

Rising Costs Are Forcing Smarter Strategy

- Influencer pricing has skyrocketed, especially post-COVID. But!! in 2025 it gets lower.

- KOCs used to accept free products — some of them still accept but part of KOCs will pick the brands they really love.

- Mid-tier KOLs have doubled fees in lifestyle niches like beauty and wellness.

- Livestreamers now ask for upfront + high commission or equity — no longer “performance only.”

Smarter targeting, better briefs, phased campaigns, and strong analytics are now the difference between profit and burn.

Algorithm Shifts = No Free Rides

- Platforms like Douyin and Xiaohongshu are tightening reach:

- Douyin prioritises content with engagement in the first hour.

- Xiaohongshu boosts saved/shared posts, not just views.

You need content that punches in the first 3 seconds and offers real value. That means:

- Emotional storytelling

- Relatable scenarios

- High save-share potential

And don’t forget: boosting (Spark Ads, etc.) is now part of the game — organic alone often won’t cut it.

Regulation Is Getting Tighter

- China is cracking down on:

- Misleading promotions

- Unverified health or financial claims

- Foreign brands violating ad law (accidentally or not)

What to do:

- Always review local ad laws before launching

- Use bilingual contracts with clauses that protect both sides

- Work with agencies (like Twish 😉) who know the terrain

From KOLs to Communities

👉 From attention to ownership Brands are moving away from one-off KOL blasts to long-term creator partnerships and private communities.

- Think WeChat groups for VIP buyers – especially for high-end brands, such as Cashmere scarf or Jewelry.

- Co-branded product lines with niche KOLs

- Brand ambassadors who grow with you over time 👉 See example of Hoka

Why? Because trust compounds. And long-term relationships are cheaper — and more powerful — than constantly chasing new influencers.

The future of influencer marketing in China.

- Costs are up, expectations are higher

- Platform reach is algorithm-gated — performance matters

- Compliance isn’t optional anymore

- The future is community-powered, not influencer-hyped

One Comment